Tips On How The Stock Market Works For Beginners

Using layman's terms, a stock market is usually a marketplace where different financial instruments like stocks, bonds, and commodities, are traded.

How does the stock market work?

Understanding how the stock market work is straightforward. The buyers and sellers are connected by the platform to negotiate prices and make trades on the stock market.

The operation of the stock market goes through a network of exchanges, such as the New York Stock Exchange and the Nasdaq.

Usually, a company's stock is listed on an exchange after the company has undergone what is known as an initial public offering, or IPO.

Related: The Best Way To Understand Value Vs Growth Stock

This is when investors buy shares, giving the company able to raise funds to expand its operations.

After that, investors can now buy and sell these stocks among themselves, while the exchange monitors supply and demand for each listed stock.

What Is a Share Market?

Explaining a stock market would be incomplete without first defining what a share market is.

A stock exchange is usually a location where shares are publicly issued and traded.

While a share is an official document that proves your ownership in a company, you can also decide to sell it to others. So, a stock exchange is where buyers and sellers meet to exchange documents.

This is why a formal marketplace for investors to buy and sell the documents known as shares has been developed to facilitate the public exchange.

Let us look into stock investing for beginners.

Types of Stock

Stock is usually classified into two types which are.

#1. Common stock

This type of stock has the majority of investors as owners of the company with special privileges.

When you successfully own common stock, you will have voting rights as well as dividends if the company's board of directors decides to pay them.

In case the company was to be sold, those who are the common stockholders would also be entitled to a portion of the assets' value. This is usually done after creditors, bondholders, and preferred stockholders were paid off.

Related: How to Make Money by Investing in Stocks

#2. Preferred stock

The preferred stock is named so due to the fact that its owners have a higher claim to the company's assets than the common stockholders.

Although, the preferred stockholders typically lack voting rights and pay a fixed dividend.

This is why preferred stock pays off more predictably. Its holders do not share in the company's fluctuating fortunes in the same way that common stockholders do.

It is for this reason that many investors do not favor preferred stock!

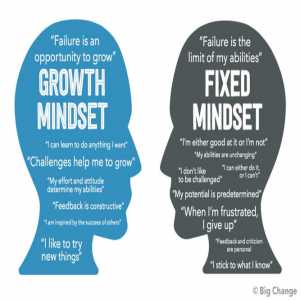

Types of Stock Market Analysis

There is so much investing information online if you want to get one.

You will discover that most of the analysis has the majority of the stock market falling under three categories: fundamental, technical, and sentimental.

Let us take a closer look at each of them.

#1. Fundamental Analysis

The fundamental analysis will help you to understand if a company's future value is accurately reflected in its current stock price.

A practical example of fundamental analysis is when you speak with a company's management team and assess how its products are received in the market.

#2. Technical Analysis

Technical analysts usually analyze recent trading activities and trends to predict what will happen to a company's stock price next.

In general, technical analysts are less concerned with the fundamentals that underpin the stock price.

#3. Sentimental Analysis

Sentimental analysis attempts to gauge the market based on investor attitudes. The sentimental analysis begins with the assumption that the vast majority of investors are mistaken.

In other words, when "masses of investors" believe prices are headed in a certain direction, the stock market has the potential to disappoint.

4 Different Types of Stock Market Risk

1. Company Risk

Even in a sector that is experiencing record growth, not every company will achieve the same results.

The performance of a company is determined by a variety of factors, including its finances, debt, growth prospects, management, and so on.

If you're interested in a specific sector, compare some of the top performers in that sector based on these factors to determine the best.

Related: Bond Vs Stock: Which One Is Better?

2. Exchange Rate Risk

Exchange rate risk is another common stock market risk.

Several businesses, particularly those in the information technology and import-export sectors, rely heavily on revenue from other countries.

3. Economy Risk

The country's overall economy has a significant impact on its stock market.

Economic growth, interest rates, inflation, and other factors are critical for the health of the equity markets.

The financial performance of a country's businesses is primarily influenced by its economic state.

If the performance of the company in which you have invested deteriorates, the risk level of your investment will rise.

4. Sectoral Risk

Changes in government policies can have an impact on sectors. For example, if the government announces a policy that is unfavorable to banks, the banking sector may suffer.

This could have a negative impact on bank performance and thus valuation.

Author Bio

For over 4 years, Saalim has worked as a branding, digital marketing, and SEO expert. He has been assisting with website design, SEO strategy, content marketing, and user experience improvements. He publishes on a variety of topics and is a contributing writer to a number of high-quality blogs and websites.

Article Comments

No Comments!

At present there are zero comments on this article.

Why not be the first to make a comment?

Similar Articles

Sponsor

Search Articles

Experts Column

Latest Articles

Featured Articles

Most Popular Articles