Successful Ways to Make Money by Investing in Stocks

Investments can help you accumulate wealth over the course of your life, and they involve less effort than you might expect.

To make money from stocks, you don't have to trade frequently, sit in front of a computer all day, or be preoccupied with stock prices. Investing's true money isn't produced from buying and selling, but from three things:

- You can also make money from receiving interest and dividends.

- When you own and hold securities.

- You can make money from the benefit you gain from your stocks' long-term increase in value.

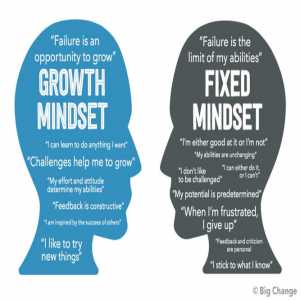

To trade stocks is a high-risk endeavor, and failure is a possibility. Stock trading, on the other hand, has the potential to be extremely rewarding if done properly with thorough research and investments in the appropriate companies.

Best Way to Invest in Stocks (Index Funds)

Investing in options will give you offers to the finest opportunity to make money in the stock market. You need to understand that Index funds invest in indices such as the S&P 500 or the Russell 1000.

Because index funds are passive, their fund managers don't constantly buy and sell equities to try to "beat the market." In addition, their main goal is to have control over the market.

Many studies have proven that active fund managers are utterly unable to beat the market when they attempt to do so. Most times, more than 90% of actively managed funds fail to outperform the market.

As a result, investing in index funds yields higher returns. In addition, because you're exposed to the whole market, they're less risky. It makes no difference if a random firm goes bankrupt and its stock price plummets to zero.

They’re still a lot easier to run, so the fees are smaller. The taxes are reduced too as the fund managers would not be buying and selling all the time.

Index funds will provide you with the following:

- It is the lowest cost.

- It also has lower taxes.

- It has better returns.

- You will bear less risk.

- Little to no effort from you.

- You will bear less risk.

It is easier to invest in different portfolios using Index funds. It's a given that they aid with diversification, but there's more you can do with them.

You can invest in a variety of index funds, including those that invest in US equities, overseas stocks, and bonds. This easy-to-manage strategy gives you a lot of gain potential while exposing you to very little risk.

If you're serious about trying your hand at stock investing, it's a good idea to think about why you want to do it.

Top Tips to Kick-start Your Stock Investment

#1. Do deep research before picking a particular company.

It is best to find out more about the company you intend to make your investment with. Sometimes, you need not follow a company because its stock price is surging, the question is, is that company the talk of the market? A wonderful new product that benefits a lot of people may have gotten the company some press recently.

Perhaps you've heard that the corporation plans to reward its shareholders with a high dividend yield? Before you do anything else, you must know exactly 'why' you are doing it.

#2. Find out how much money you intend to gain from your investment.

Don't forget that you're already familiar with the concepts of capital gains and dividend taxation. How much do you believe a reasonable return on a $1,000 investment is? Investing $10,000 or more means you're definitely hoping to make a bigger profit.

#3. Understand the stock market language.

The stock market is more than just understanding investments, dividends, and shares. Since the stock market has its own legal vocabulary, it's a good idea to familiarize yourself with it before making any stock market investments.

#4. You must know how long you need to hold on to your shares.

It doesn't matter if you're expecting capital gains or dividends from your stock market investment; time will ultimately determine its profitability.

It's a good idea to invest money that you won't need for a while and keep it in the business for the long run.

Sometimes, it is best to become a stock market trader if you want to make money fast. This is a riskier option and isn't recommended unless you have a solid background in stock market investment.

Tips on Penny Stocks

Microcaps, small caps, stocks under $5, and other terms are all used to describe penny stocks. Even yet, not all of them are available for public trading on a major stock market, and they all require a different strategy than other equities.

Top 4 Tiers of Penny Stocks

#1. The Tier 1 Penny Stocks

Tier 1 penny stocks are those traded on major stock exchanges like the NASDAQ and the New York Stock Exchange. They're normally less than $5 a share, although they can be a little more pricey on occasion as well.

They're held to a higher standard than OTC penny stocks since they have to supply the exchange with financial information, making them less susceptible to manipulation.

#2. The Tier 2 Penny Stocks

Typical penny stock prices range from one cent to 99 cents.

#3. Tier 3 Penny Stocks

These are penny stocks, with a market value of less than one penny. In the end, these businesses aren't robust enough to support a penny per share stock price. These shares are not traded on the NYSE or NASDAQ.

#4. The Tier 4 Penny Stocks

These are so-called "triple zero" equities, which are worth between 0.0001 cents and 0.0009 cents per share. Hot penny stock alerts are frequently issued for these securities and largely benefit investors who purchased the securities early on.

Author Bio

Contributor comprises full-time and freelance writers that form an integral part of the Editorial team of Hubslides working on different stages of content writing and publishing with overall goals of enriching the readers' knowledge through research and publishing of quality content.

Article Comments

No Comments!

At present there are zero comments on this article.

Why not be the first to make a comment?

Similar Articles

Sponsor

Search Articles

Experts Column

Latest Articles

Featured Articles

Most Popular Articles