Bond Vs Stock: Which One Is Better?

Have you been asking yourself the question bond vs stock: which one is better? Generally, if you want to invest in a company, you have two options: equity (also known as stocks or shares) or debt (also known as bonds).

Stock

Stocks represent a company's partial ownership or equity. When you buy stock, you're actually buying a small piece of the company called a "share."

.jpg)

Various types of Stocks

There are two main types of stock - Common and preferred stock

Preferred stockholders will receive payouts and dividends before common stockholders - in other words, preferred stockholders have a higher claim on the company's first asset payout, whereas common stockholders have no guarantee of payment.

Bonds

Bonds are a type of loan where you lend money to a company or the government. There is no need to invest any money or buy any stock.

Simply put, when you buy a bond, a company or government is in debt to you, and it will pay you interest on the loan for a set period of time before repaying the full amount you paid for the bond.

.jpg)

Bond vs Stock

When it comes to asset allocation, knowing the differences between stocks and bonds is crucial.

One of the most important indicators of an investment portfolio's risks and rewards is the allocation of stocks and bonds.

A stock fund invests in publicly traded companies by purchasing shares, each of which represents a fractional ownership interest in the company that issued the shares.

Bond funds invest in bonds issued by the federal government, state and local governments, businesses, and other entities.

Consider a stock fund as owning a piece of a public company while bond funds as a way to lend money in exchange for a fixed interest rate.

The investor's rights, return prospects, and risk exposure will differ depending on which path they take.

.jpg)

Differences between stocks and bonds

We'll examine the differences between stocks and bonds, as well as the most cost-effective ways to invest.

Shareholding

When investors purchase stock in a corporation, they become one of many shareholders.

Significant shareholders can shape the company's strategy and have the right to vote on and veto corporate proposals as a result of their ownership.

Sold differently

Stocks and bonds are sold in different ways.

Stocks are traded on a variety of exchanges around the world, but in the United States, they are traded on the American Stock Exchange (AMEX), Nasdaq, or the New York Stock Exchange (NYSE). The Securities and Exchange Commission regulates and supervises all of these markets (SEC).

Bonds, on the other hand, are typically sold over the counter rather than on a central exchange like stocks.

.jpg)

Purchasing

When investing in bonds, you must first decide which type of bond you want to buy - corporate bonds, municipal bonds, or treasury bonds are the most common.

The majority of investors will buy stock in the stock market through stockbrokers. Citigroup, E-Trade (ETFC), and Ameritrade are some of the most popular brokerage firms.

When purchasing stocks, it is critical to be well-versed in the stock market in order to make the best decisions.

Online stock

You must consider your immediate needs as an investor when selecting an online stock broker. If you are new to the game, perhaps you require a broker who can provide you with excellent educational materials on the stock market.

Risk

Bonds are debts, whereas stocks are shares of a company's ownership. Because of the nature of the stock market, stocks are also riskier in the short-term considering the amount of money an investor may lose practically overnight.

Stocks, on the other hand, have historically proven to be extremely valuable over long periods of time.

.jpg)

Pricing

Another significant distinction between stocks and bonds is that their prices tend to be inversely related: when stock prices rise, bond prices fall, and vice versa.

Bond prices have historically fallen on lower demand when stock prices are rising and more people are buying to profit from that growth.

When stock prices fall and investors seek lower-risk, lower-return investments like bonds, demand for them rises, and so do their prices.

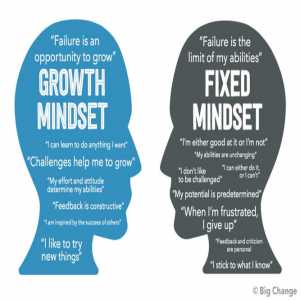

Differences between investing and trading

Another thing to think about is the difference between investing and trading. When people talk about investing, they're usually referring to the purchase of assets that will be held for a long time.

These investments are typically made to help you reach a retirement goal or to put your money into assets that will grow faster than a traditional savings account earning interest.

Trading, on the other hand, usually entails buying and selling assets over a short period of time. Trading is thought to be riskier than investing.

.jpg)

It is critical to determine your risk tolerance before investing in bonds or stocks. Don't put money into something you can't afford to lose, and seek advice from a professional financial adviser.

As part of a well-diversified portfolio, bonds and stocks can complement each other. This is because they have low correlations with one another, which means they react to changes in the economic cycle in different ways.

Author Bio

The Editorial staff includes content researchers from various areas of knowledge. They add a plethora of expertise to the Hubslides Editorial team. They constantly and frequently oversee, produce and evaluate contents that are most ideal to aid impacting knowledge to readers.

Article Comments

No Comments!

At present there are zero comments on this article.

Why not be the first to make a comment?

Similar Articles

Sponsor

Search Articles

Experts Column

Latest Articles

Featured Articles

Most Popular Articles