The Best Way To Understand Value Vs Growth Stock

Today, the Growth stock businesses have shown above-average earnings growth. This growth is expected to deliver a high level of profit growth for the investors. Although the growth can be guaranteed.

Top Characteristics of Growth Funds

#1. Higher priced than broader market.

Here investors would be willing to pay a high price to earnings multiples. Their main expectation is the fact that they hope on selling the stocks at higher prices as the companies grow.

#2. High earnings growth records.

Although, some company's earnings may plummet when the company is experiencing slower economic improvement; the growth companies would be able to keep steady growth regardless of economic conditions.

Value vs Growth Investing

In general, value stocks have underperformed growth stocks over the last decade.

Let's go a little deeper.

#1 Investing for Value

Value investors seek out low-cost investments. So, they primarily lookout for those stocks that are already trading at a discount to the value of the companies they represent.

If they believe a stock is underpriced, it's a good time to buy. If they think it's overpriced, it's a good time to sell.

This is why value investors try to drive the price up as the security returns to its "fair market" price, then sell it as the price is reached.

One important fact is that a lot of value investors carry out extensive research to understand those stocks that may be undervalued.

Often time, they carry out the research by looking over the company's balance sheet, financial statements as well as cash flow statements because it will give them a good idea of its assets, liabilities, revenues, and expenses.

#2. Investing for Growth

Today's data is being used by growth investors to identify tomorrow's best stocks. They watch out for the winners which are usually the stocks of companies in the industries that are expected to grow significantly.

They look for companies that can generate higher-than-expected revenues or earnings. Whereas value investors rely on analysis, growth investors rely on criteria.

Most growth investors are focused on whether the behavior of a company could give an idea of the company becoming tomorrow's leaders. They care less about the underlying company's value.

What are value stocks?

Most of the stocks are placed under two categories which are: value stocks or growth stocks.

But, you may also find out that some stocks may have both attributes or fit in with average valuations or growth rates. So, their characteristics will determine whether they are value stocks or growth stocks.

How to Find Value Stocks to Invest In

Your number one goal of value investing is to discover those companies that are trading at a discount to their intrinsic value. While you also hope that they will outperform the overall stock market over time.

This is why getting those stocks that trade for less than their true value is easier said than done. After all, if it were simple to buy $1 for $0.80 over and over again, everyone would be wealthy.

Let’s find out some of the metrics that you need to consider when searching for value stocks to invest in. these are the three of the best metrics to keep in your toolbox as you look for hidden gems:

P/E ratio

This is one of the popular stock-valuation metrics. The price-to-earnings (P/E) ratio is a functional tool that will help you to compare the valuations of companies in the same industry.

To calculate the P/E ratio, you can simply divide a company's stock price by its last 12 months of earnings.

PEG ratio

Another tool that may be similar to the P/E ratio is the PEG ratio. Although, the PEG ratio differs from the P/E ratio in the sense that it adjusts to level the playing field among companies that may grow at slightly different rates.

Price-to-book (P/B) ratio

The Price-to-book (P/B) ratio is the value that would be left if a company ceased operations and sold all of its assets.

When you calculate a company's share price as a multiple of its book value, you will easily understand the undervalued opportunities. This is why many value investors seek out opportunities to buy stocks trading for less than their book value.

Market to Book Ratio

Another metric is the market to book ratio which carries out its valuation by comparing a stock price to its book value.

Sometimes it is referred to as the price-to-book (P/B) ratio.

To carry out the calculation of the market to book ratio, you should divide the company's market capitalization by its book value.

Then the book value of a company can be calculated by subtracting its liabilities from its assets. This will then become the amount of money left after selling all assets and paying off all liabilities.

When you have a high market-to-book ratio, it shows that a stock is overpriced, on the other hand, a low ratio indicates that it is underpriced.

Growth Stocks vs. Value Stocks

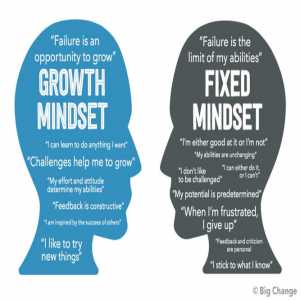

Many investors are surprised by the distinctions between growth and value stocks. The main difference between the two stocks is usually not in how they are purchased and sold, nor in how much ownership they represent in a company.

Instead, the main difference is found in how they are perceived by the market and the investors. The earning of the growth stock investors comes from future capital appreciation, rather than dividends.

In general, value stocks have low current price-to-earnings and price-to-book ratios.

Author Bio

This user has not submitted a user bio yet

Article Comments

No Comments!

At present there are zero comments on this article.

Why not be the first to make a comment?

Similar Articles

Sponsor

Search Articles

Experts Column

Latest Articles

Featured Articles

Most Popular Articles