Accounting And Accounting Software for Small Business

Accounting is regarded as an art form in and of itself. It entails financial data processing and interpretation.

Now that you've enrolled in an accounting course, you're probably aware that there are a variety of accounting jobs available to you once you've completed your studies.

You would have a better chance of landing a job as a certified accountant if you pass the CPA test.

Accounting is extremely significant, and as a result, it is regarded as a necessary business method.

.jpg)

Categories of Accounting

Accounting is divided into many categories, so if you plan to pursue an accountancy profession in the future, you can find that there are several different types of accountancy professions to choose from.

Private Accountant

To begin, you could work as an industrial or private accountant.

This type of accounting is restricted to a single company in this situation.

You can only work for one employer if you want this occupation.

You must provide your employer with the best service and expertise, and the employer will compensate you.

Public Accountant

Serving as a public accountant is the second accountancy career choice.

You will represent the general public if you are already a CPA.

Once you have established the so-called practitioner-client link or partnership, you will be referred to as a public accountant.

And those who are not yet licensed accountants can practice their profession.

CPAs also form relationships and have a diverse client base ranging from the local community to national and even foreign clients.

.jpg)

Government Accountant

Another choice is to work as a government accountant.

Working for the government, whether local, state, or federal, is a requirement of this occupation.

Traditional accounting techniques are also used in government accounting.

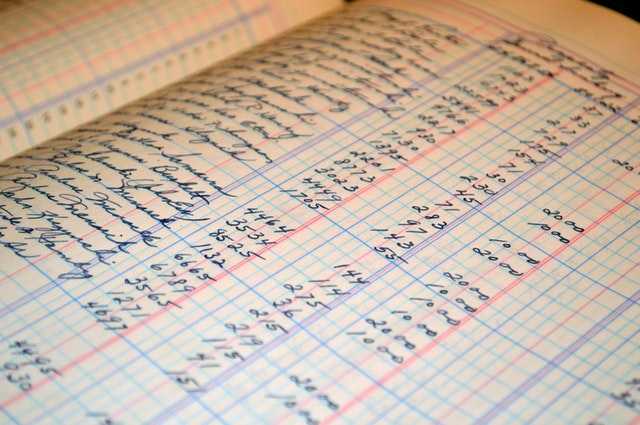

You will use both papers and ledgers, and double-entry systems. If you work for the government, you will be more focused on providing service.

Since government agencies exist to represent the people, they are not concerned with profits.

Fiduciary Accounting

Another form of the accounting profession is fiduciary accounting.

Accounting is based on confidence in this case. Fiduciary accounting may be done by executors, managers, trustees, or someone else who is trustworthy.

A fiduciary accountant is responsible for keeping important records and preparing reports.

The courts have the authority to appoint these fiduciary accountants.

National Income Accountant

The final choice is to work as a national income accountant.

This form of job relies on social and economic principles rather than the idea of a company.

It is your job as a national income accountant to have a public estimate of a country's annual buying power.

.jpg)

Accounting Software

Whether you're looking for accounting software to help you manage your personal or company expenses, you might find that organizing all of your files in one program

This saves you time and allows you to see where your money goes.

If you've ever worked in accounting, you know how confusing ledgers, account statements, debits, and credits can be.

A variety of vendors have developed tools specially designed to help make your life a little simpler in order to ease the accounting process.

Keep the following considerations in mind when choosing an accounting software program:

Check reviews

Since several prominent online software specialty stores allow consumers to leave product feedback, you will be able to read reviews that will help you make an informed decision based on the experiences of those who have used the accounting software in question.

When purchasing software, pay careful attention to customer feedback.

PC compatibility

Before buying any form of software, even accounting software, make sure that it is compatible with your computer and that all PC specifications are met.

Many software programs necessitate a particular processor, memory, and other specifications.

Your system must be capable of handling all of the applications found in the program in order for it to work properly.

You will be able to make a better choice when it comes time to buy new accounting software if you are familiar with your computer's setup.

Software capabilities

Read the program's definition and capabilities before purchasing accounting software.

You must ensure that you are either already familiar with the program or that learning how to use it would be simple for you.

The explanation for this is that many retailers would not allow software that has already been opened when it is returned.

Consider installing a free version or purchasing an accounting software package that you are already familiar with before making a purchase.

Purchase from reputable vendors

Purchase accounting software from a reputable firm that has been in operation for a long time.

This will ensure prompt customer support, product reliability, and timely shipping.

You will have peace of mind knowing that the software you're buying is genuine and not a pirated copy if you buy it from a reputable and well-established company.

Software policies

Learn about the return, repayment, and/or swap policies of the company.

While most retailers would not refund purchases after software has been opened, if the program is faulty or damaged, they might be able to swap it for the same title.

You now understand the various forms of accounting careers.

You must make wise decisions because your future career is at stake.

While you are still in school, you can already decide on a career path.

Plan ahead and you will be able to achieve all of your life objectives if you do so.

Author Bio

Contributor comprises full-time and freelance writers that form an integral part of the Editorial team of Hubslides working on different stages of content writing and publishing with overall goals of enriching the readers' knowledge through research and publishing of quality content.

Article Comments

No Comments!

At present there are zero comments on this article.

Why not be the first to make a comment?

Similar Articles

Sponsor

Search Articles

Experts Column

Latest Articles

Featured Articles

Most Popular Articles

.jpg)