Tips To Calculate The Debt To Income Ratio

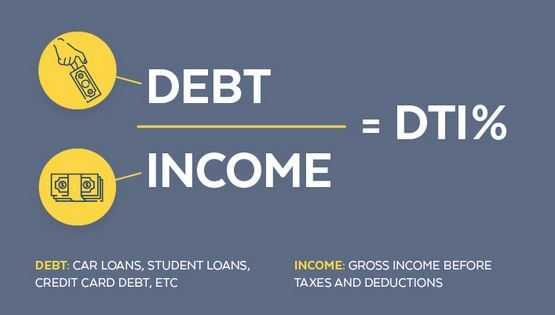

When you divide your monthly debt payments with your monthly gross income you will be able to get your debt-to-income ratio (DTI).

You must note that your debt-to-income (DTI) ratio as well as the addition to your credit score will give you an understanding of your overall financial health.

So, when you calculate your DTI, it will help you to decide how comfortable you are with your current debt and also help you to decide if applying for credit is the best option for you.

Most times, the mortgage lenders will consider your DTI when you are applying for loans. The aim is for them to be able to determine the risk of you taking on another payment.

The importance of debt to income ratio

A debt-to-income ratio is a tool used by financial institutions to find out the best way to balance your budget. It also helps them to assess your creditworthiness.

Before extending credit or making a loan to you, lenders want to know that you're making enough money to pay off all of your debts.

So when you have a low ratio, it makes you a better candidate for both revolving and non-revolving credit.

How to calculate your debt-to-income ratio

If you want to calculate your DTI, all you need to do is to add up your monthly debt payments. This includes your rent/mortgage, student loans, auto loans, and credit card minimum payments.

Then determine your gross monthly income which is the income before taxes.

When you have the two parameters above, you can now calculate your debt-to-income ratio by dividing your monthly debt payments by your gross monthly income.

Common Factors that make up a DTI ratio

In case you want to know your DTI ratio has two components that all mortgage lenders would need to use, this is a front-end ratio and a back-end ratio.

Let us take a deeper look at each one and how it's calculated:

Front-End DTI

The front-end ratio is meant to help the lenders to understand the percentage of your monthly gross income going toward housing expenses. The following are always included in front-end DTI: your monthly mortgage payment, property taxes, homeowners insurance, and homeowners association dues.

Only housing-related expenses are included in the front-end DTI.

Back-end DTI

On the other side, the back-end ratio will give them a full understating of your income. Part of what they will get to know is if your income can cover all of your monthly debt obligations, in addition to your mortgage payments and housing expenses.

When you go through the mortgage process these two things will be highly considered.

What is a Good DTI Ratio?

How can you measure a good DTI ratio? You must note that the highest DTI ratio a borrower can have and still remain qualified for a mortgage is 43 percent.

Most Lenders would prefer a debt-to-income ratio which is less than 36 percent. Although this ratio must have no more than 28 percent of that debt dedicated to mortgage or rent payments.

So the best DTI ratio is mostly determined by the lender.

However, the lower the debt-to-income ratio, the more likely the borrower will be approved, or at least considered, for credit.

What counts as debt?

Debt is a difficult concept to define. For example, mortgage companies like to include your current mortgage payment when calculating DTI, but if you are currently renting, that is not a debt.

Other borrowings, such as an overdraft, are considered debt but do not require a monthly payment. So, what exactly constitutes recurring monthly debt?

Your housing costs

If you are looking for a mortgage, the amount your prospective lender will use will be the cost of the mortgage you will receive.

So, even if you are renting (which is technically not a debt) or intend to sell your current home, use the monthly repayment value for the mortgage you intend to obtain.

Don't know what I'm talking about? To get a good estimate, use this mortgage repayment calculator.

Credit card bills

A good rule of thumb is to calculate based on your monthly minimum payment; however, this can be misleading, and it's better to go a little higher because minimum payments don't demonstrate a genuine desire to pay off the debt.

A more precise figure would be 1.5 times your monthly minimum payment.

Vehicle finance

Include this total whether you bought a car on credit or leased one.

You do not need to include the amount you paid for insurance or vehicle excise duty (road tax), nor do you need to include your monthly fuel bill.

Personal loans

Add the monthly payment for any unsecured personal loans you have with a bank, peer-to-peer lending service, or another provider to the total.

Overdraft

If you are constantly living on an arranged overdraft, you are jeopardizing your chances of getting a mortgage.

It is important to prioritize repaying an overdraft as soon as possible.

Author Bio

This user has not submitted a user bio yet

Article Comments

No Comments!

At present there are zero comments on this article.

Why not be the first to make a comment?

Similar Articles

Sponsor

Search Articles

Experts Column

Latest Articles

Featured Articles

Most Popular Articles